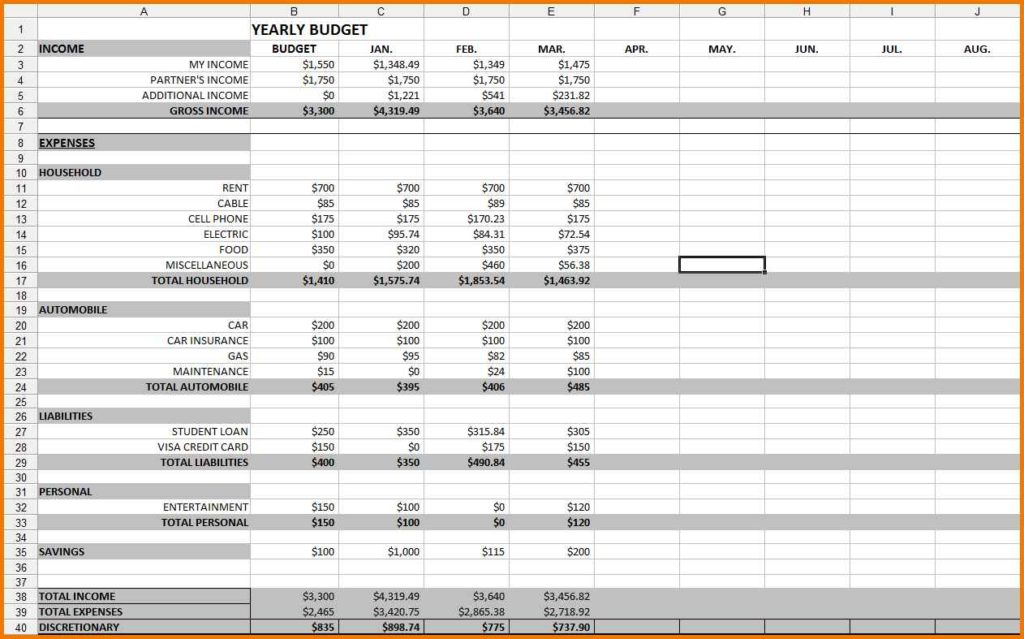

If you enjoy the excel tutorials and find them useful, it would be great if you leave a comment. You could compare this to what months you have the most expenses going out. You need a level of financial awareness that perhaps even Paul Krugman doesnt possess.

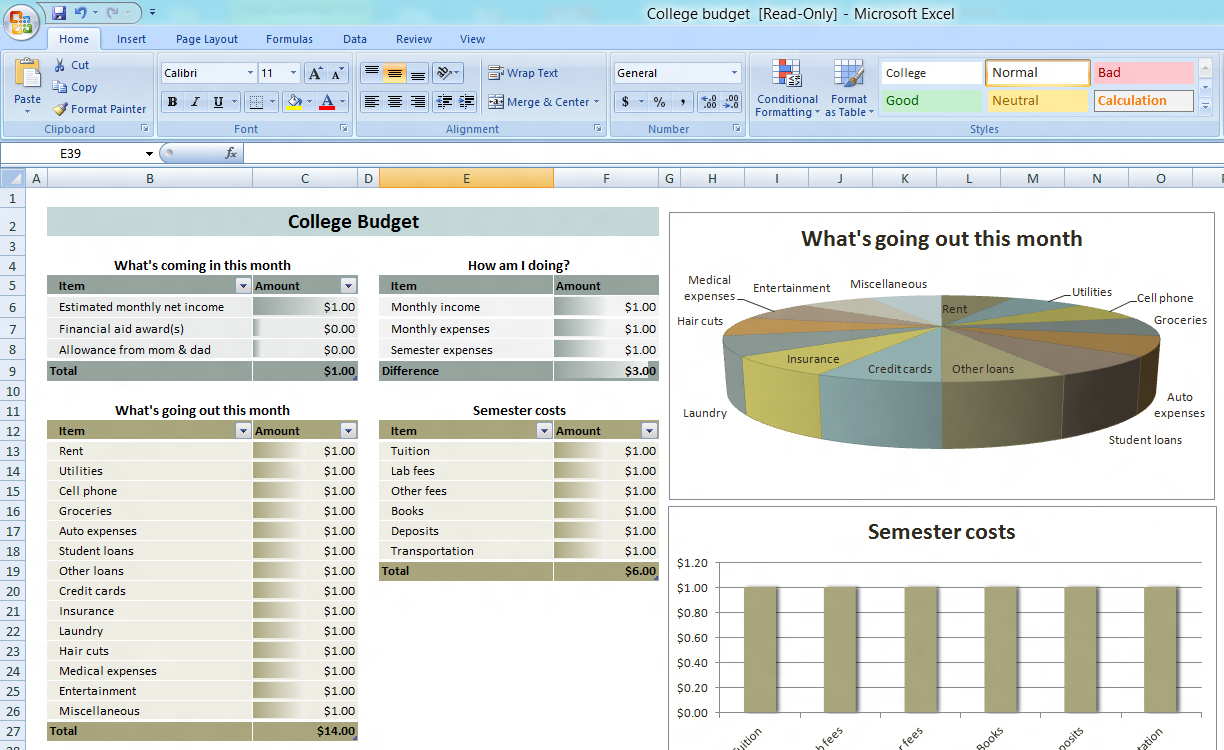

When youve got a mortgage, children, a car payment, and other expenses to keep track of, its hard to balance the budget and avoid overspending. If you have irregular income, you could graph your income to see what months bring in the most income. Here are 15 of their best financial spreadsheets. If you have investments, then you could use a line graph to track your investment portfolio. So every time you put money into your savings, your savings column will automatically rise towards your target.

Track monthly expenses excel update#

The great thing about Excel is that if you change your data in your spreadsheet, your chart will automatically update to show the current data. If you are saving for something specific, you could chart the target amount that you need to save and your actual savings to date. If you are comparing actual expenses with budgeted expenses, for example, you could use a column chart to make the comparison. Once you know the basics, you can chart any information that you like. There are plenty of other charting options that I didn’t touch on here, have a play around to try out these option.

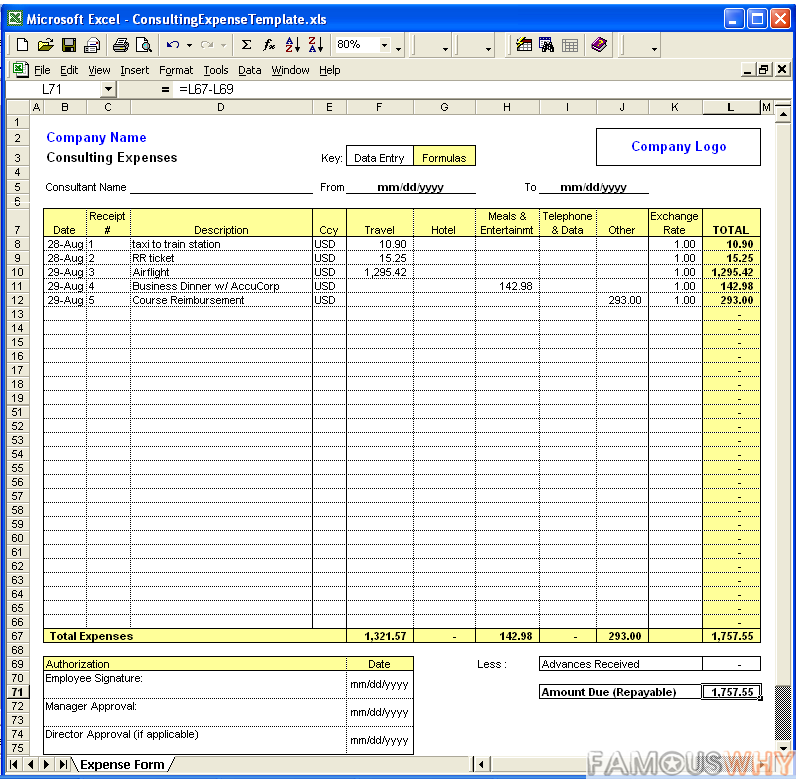

You should always consult a qualified financial expert when making money decisions to tailor plans to suit your circumstances. The purpose of expense tracking template is by definition itself to keep track of the in and out of money mostly expenses occurred for certain products or. In this blog, I share my savings and budget planning and what works for us. All figures are made up.ĭisclaimer: This is general information only. It condenses all those numbers down into a visual representation that has immediate meaning.įor this tutorial, I’ll be using the same budget spreadsheet as I used in the loan calculations tutorial.

Track monthly expenses excel full#

And I realised for the first time just how much of our income was going towards our mortgage.Ī sheet full of numbers is great, but for an instant idea of how your finances are, you can’t beat a graph. I could see our finances for the first time. aug 2022 The Best Templates to Track Personal Expenses in Excel Lee.

The numbers that had been staring me in the face for years suddenly jumped up and had meaning. The Personal Money Tracker shows the Cash. The second sheet is a streamlined summary chart of your budget vs. The first sheet is dedicated to tracking your expenses in various categories throughout weeks, months or years. It was just for fun really (I know, I need to get out more!), but what I found really surprised me. This personal expense template contains three worksheet tabs: Personal Money Tracker, Monthly Summary, and Chart Data. Expense Tracking Sheet This template is perfect for both personal use as well as small business use. Just after we first bought our house, I decided to create some graphs. Previous to that, our budget was kept in a little exercise book. I have been keeping my budget in excel for four years now. Salary: To ensure that when you’re young, you are improving your income every 1-2 years to beat inflation and growing in your career.īy keeping track of your personal finance, you can ensure that you are on track to meeting your goals hold yourself accountable and feel motivated to improve.Charting your budget in Excel.We start by downloading credit card expenses into Excel, cleanin. Income Tax Relief: Understand what you need to do in order to reduce your income tax This step by step tutorial walks you through a simple credit card expense analysis in Excel.Insurance: Consolidate all insurance policies to understand what are your gaps.Monthly Savings & Expenses: Keep track of your monthly expenses and the specific percentage you are able to save from your take-home salary.Asset Allocation: View all your assets in a single view to understand how much you have in total, the percentage breakdown, and where they are.To help you, I have created a super useful excel template to help you to track your personal finances. There are five key components to this template which will help you benefit in the following ways: If your goal for this year is getting your personal finance in order, your first step is really to start keeping tracking of personal finances: knowing where you are, what you need to do to meet the numbers you want. What I have learned in life when it comes to keeping track of your personal finances is that “If you can’t measure it, you can’t manage it.”Īfter all, if you are trying to achieve a goal, the more often that you monitor your progress, the greater the likelihood that you will succeed.

0 kommentar(er)

0 kommentar(er)